Many college students may not realize that they are a prime target for scammers. It can be easy to mistake a scam for a legitimate business or offer. Better Business Bureau of Central New England has red flags to help college student identify common scams that could target them.

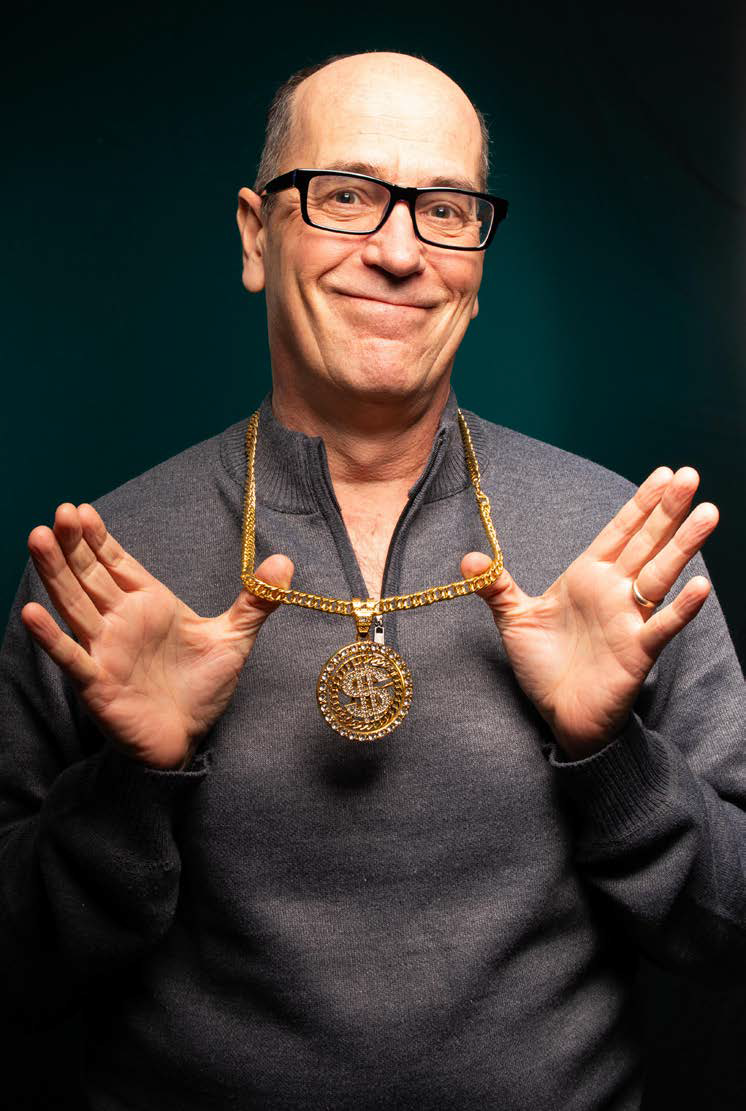

“Scammers may approach college students from a variety of angles, including employment offers and rental schemes. There is no shortage of avenues to approach this demographic,” said Nancy B. Cahalen, president and CEO of the Better Business Bureau of Central New England. “Scammers are savvy, and college students may not be aware of common tactics. BBB has resources and information to help if you are ever unsure of a business, offer or solicitation.”

A little background on common scam and red flags can help students become savvy in the marketplace:

Roommate/rental scheme. If you post an ad for a roommate on Craigslist, beware of “fake roommates” who are out of the country but can provide the rent upfront in the form of a money order. When you receive it, the amount is higher than the amount requested. You are asked to cash it and wire back the rest. Wired funds cannot be retrieved; if you follow the instructions, you may be held liable for bank fees and any lost funds.

Employment. Beware of ads that pop up near campus offering jobs with “no experience necessary.” Often, these “opportunities” are bogus. If you are interviewed in a hotel lobby, are required to sign a contract or have to pay for everything, including training, travel, lodging, food, etc., associated with the job, forget it! Check out a company first at bbb.org.

Scholarship/grants. Scholarship-finding services “guarantee” grants or scholarships. They sell lists to students of potential scholarship or grant opportunities. However, nearly all available financial aid comes from the federal government or individual colleges. Go to grants.gov for more information.

Online shopping deals. You see a much-wanted item for a steep discount online. One you could not usually afford. The catch? The site asks you to wire payment to them instead of using a credit card – a huge red flag. Once the money is sent, the item is never received.

Cheating supplies. Students can find term papers and test questions and answers, but universities are increasingly using new software like Turnitin, fake websites and spy cameras to track down dishonest students. Don’t cheat yourself out of learning!

Illegal downloads. It may be tempting to save money by downloading free music, movies or textbooks, but many contain spyware that can end up causing financial havoc.

Locksmith scams. College students are prone to locking themselves out of their homes or cars. If this happens, you probably will use your cell phone or the local yellow pages to find a nearby locksmith. The problem is some disreputable locksmiths will post bogus addresses in their yellow page ads to make them appear local when they’re not.

Being a savvy consumer starts with developing good habits. BBB recommends that students take the following seven steps to avoid being victim of scams:

- Send sensitive mail to your parents’ home or a post office box. School mailboxes are not always secure and often can be accessed easily in a dorm or apartment.

- Important documents should be stored under lock and key. This includes your Social Security card, passport and bank and credit card statements. Shred credit card offers and any paper documents that have sensitive financial information rather than just tossing them out.

- Never lend your credit or debit card to anyone. Just say no if your friend wants to borrow your card or asks you to co-sign for a loan or financing for items like a TV.

- Make sure your computer has up-to-date antivirus and spyware software. Always install any updates and patches to your computer’s operating system or browser software, which help keep your computer safe from any new advances by identity thieves online.

- Always check your credit or debit card statements closely for any suspicious activity. The sooner you identify any potential fraud, the less you’ll suffer in the long run.

- Check out unfamiliar websites at bbb.org when shopping online. Look for the BBB Accredited Business seal along with other trust seals; click on the seals to confirm that they are legitimate.

- Check your credit report at least once a year. You are entitled to one free report a year from each of the three reporting bureaus: TransUnion, Experian and Equifax. Look for any suspicious activity or inaccuracies. You can do this for free by visiting annualcreditreport.com.

Better Business Bureau of Central New England, Inc. was founded in 1940 and serves 225 communities in Worcester, Hampshire, Hampden, Franklin and Berkshire counties, as well as parts of Middlesex County and seven towns in Connecticut. BBB of Central New England is one of 113 local, independent BBBs in the United States, Canada and Mexico.