Going off to college, whether for your freshman or senior year, is always a scary – but really fun – experience. Making it even scarier are all the statistics and stories about what awaits today’s college graduates: student loan debt.

In a recent Wall Street Journal article that cited data compiled by Edvisors, the Class of 2015 is the most indebted ever (not a difficult feat, as debt continues to rise each year). The average student loan debt of a 2015 graduate is $35,000 – not counting interest you’ll accumulate during your loan period.

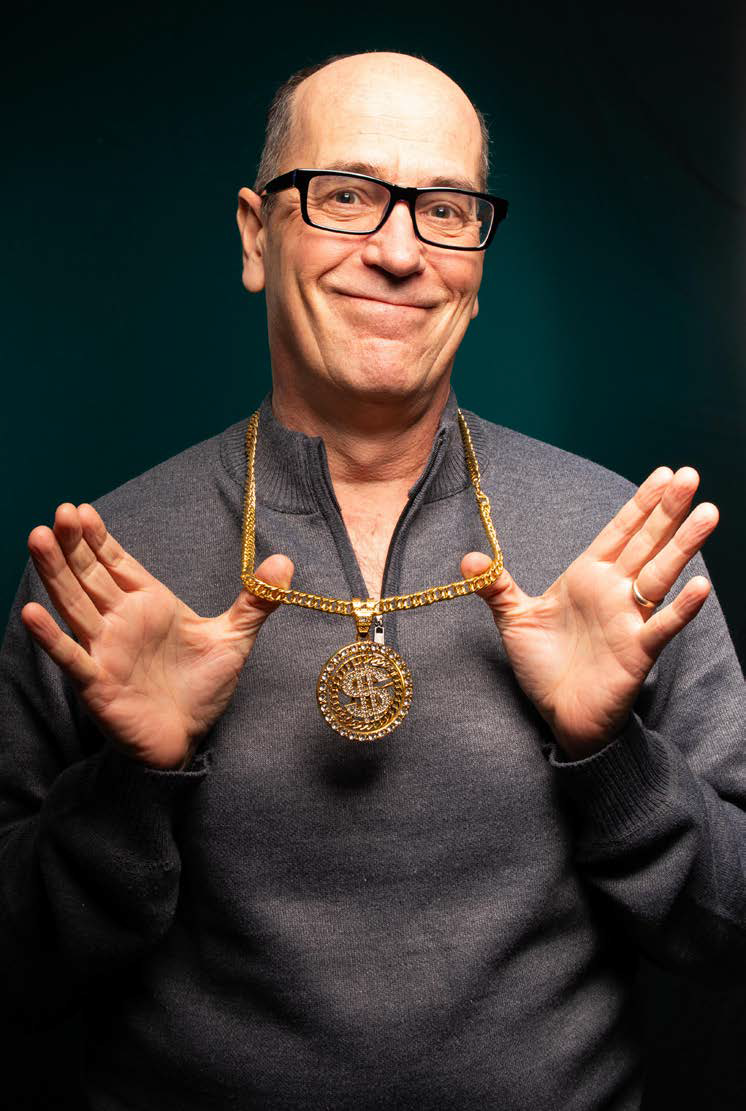

Unless you’re extremely lucky and your parents are footing the bill, you’re going to need to be on a tight budget for the next few years to ensure you won’t have a heaping pile of credit card debt to complement your student loans. Michelle Perry Higgins, an award-winning financial planner, has got you covered in her latest book College Poor No More. In her book, Higgins offers 100 savings tips tailored to help students survive the college years without having to eat Ramen every night.

According to Higgins, being poor in college is neither a bad thing nor a rare thing. As this is the time in which you transition from your teen years to adult independence, these are the best years to practice money and life management skills. So accept the truth: You are poor. And learn to embrace it. However, being frugal doesn’t have to be boring – you just need to be a little more creative with how you spend your money. This book is packed with ways you can be spend-savvy in many different aspects of college life – like housing, cooking, eating, travel and social occasions. For example:

According to Higgins, being poor in college is neither a bad thing nor a rare thing. As this is the time in which you transition from your teen years to adult independence, these are the best years to practice money and life management skills. So accept the truth: You are poor. And learn to embrace it. However, being frugal doesn’t have to be boring – you just need to be a little more creative with how you spend your money. This book is packed with ways you can be spend-savvy in many different aspects of college life – like housing, cooking, eating, travel and social occasions. For example:

- You don’t need to blow your money on iTunes when you can listen to Pandora and Spotify for free.

- True dollar stores sell pretty much the same stuff as other stores. It’s time to let go of being a brand snob and go generic.

- If you’re not already a Sriracha fan, it’s time to jump on the bandwagon. Hot sauce makes any dorm or leftover food taste better.

- Duct tape really does solve almost any problem. (Check your local dollar store.)

- Always use a coupon and/or take advantage of student discounts. Although the minimal savings might not seem to be worth the effort, it equals bigger savings in the end.

Higgins’s tips aren’t just for college students either. Are you a recent grad, a starving artist (literally or figuratively) or someone simply looking to cut excessive costs? This book might also be of interest to you. Although I’ve been out of college for 10 years (and am still saddled with undergrad and grad school loans), I still found some of Higgins’s cost-cutting tips useful.

But the best part about this book is that 100 percent of the profits go to providing scholarships for deserving students. Get your copy on Amazon or at your local bookstore today.

By Kimberly Dunbar